Asian Market for Wood Pellets

Wood pellets may play a limited but significant role in the renewable portfolios of Japan, South Korea and China.

During the past several years, most reports about wood pellet export markets have focused on European nations. A logical question, especially for businesses in western North America, concerns the status of potential export markets in Asia. In 2011, the Alaska Wood Utilization and Marketing Center and the Center for International Trade in Forest Products conducted a project to review recent regulations and policies in South Korea, Japan, and China that could potentially increase the use of renewable wood energy products, specifically wood pellets.

A brief summary of findings is that all three nations have legislation and policies in place that mandate conversion to renewable sources of energy, and the major use for woody biomass is for industrial wood pellets that are to be cofired with coal.

On Markets

In Japan, South Korea and China, the total market is composed of wood pellets designed for two different uses. The first part of the market is for domestic use as a source of energy for space heating; the second component is a wood pellet for industrial use, mainly cofiring with coal to produce electricity.

How to make wood pellets and you will know more by linking here.

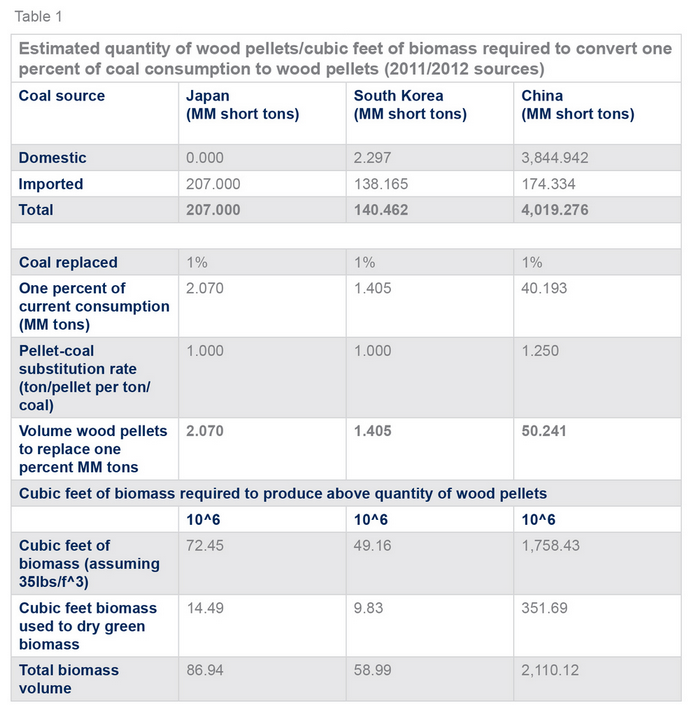

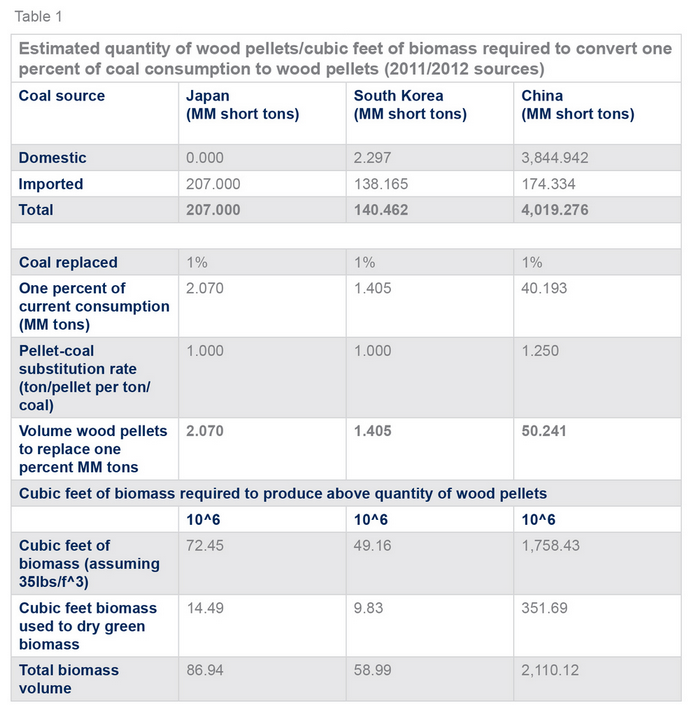

The major market objectives in the aforementioned nations will be for reducing carbon emissions through cofiring. Table 1 reports the current levels of coal they consume. When reductions in fossil fuel usage through cofiringare discussed, conversion benefits are often reported in terms of the amount of coal replaced, or the amount of wood pellets required as a substitute for 1 ton of coal. In reality, wood pellet/coal replacement rates are dependent upon coal properties. The coal imported into Japan and South Korea is classified as lignite, the heat content of which is not vastly different than wood pellets, whereas it appears that the coal mined in China is of higher energy content and greater volumes of wood pellets will be required for replacement.

Table 1 conveys an idea of the amounts of wood pellets required to replace 1 percent of the coal consumed by each of the three Asian nations. Mills procuring biomass for production of pellets purchase raw material by weight or cubic content. The table also provides a basic understanding of the magnitude of the difference between the nation with the greatest level of energy consumption, and two other nations. Replacement of 10 percent of the coal in China by cofiring would approximately require a staggering 500 million tons of wood pellets annually.

A very common question asked when discussing markets is, “Whom do I contact?” In Japan, based on existing legislation and early market development, the answer appears to be “the major power companies.” The market for industrial wood pellets in Japan seems to be taking the form of an oligopsony (small number of buyers, large number of sellers). Future developments will further define the market as one that is open. It is also possible, depending upon how contracts are negotiated, that participation will be by invitation only.

In South Korea, the answer is not as clear. The Korean Electrical Power Company produces 93 percent of the electrical power used in the nation, and 51 percent of the KEPCO is owned by the Korean government. The South Korean Forest Service is promoting wood energy research, and is jointly developing wood energy technology and resources with other countries. In March 2009, the Korean Forest Service and the Indonesia Forest Ministry signed a pact to put aside 200,000 hectares (494,000 acres) of forest land in Indonesia to produce wood pellets starting in 2010. It may be too early to define the market type that will exist in South Korea, but initially, it has many characteristics that point to a monopsony (one buyer is a government agency). As with the market in Japan, participation in the South Korean market may be invitation only. Given this approach, it is possible that a South Korea market for North American firms will never develop.

It is difficult to predict the future market type that will exist for wood pellets in China. The immediate response of some individuals would be monopsony, but this may not be reality. A recent report noted that generating facilities in China are classified as state-owned and directly under government control or as “independent plants” owned by provincial governments and private investors. Given this fact, and reported information about the resources of the country, a number of scenarios are possible.

Reviewing Resources

China does not have an extensive forest resource. The natural forest is poorly distributed over the country, and supports stands are of marginal quality. Since the mid-1960s, an area in excess of 115 million acres (an area equivalent to 20 percent of total commercial forestland in the U.S.) has been planted to softwood and hardwood plantations. While the effort is impressive, little attention was paid to wood quality of the planted material, which will not meet the quality standards for many solid wood products. It will, however, provide some fiber for pulp and paper and energy use.

Given the lack forest resources, the solid forest products industry is dependent upon imports of both hardwood and softwood logs. Hardwoods logs are purchased from throughout the world, with major amounts coming from tropical sources. Softwood logs are imported from Pacific Rim nations and Russian Siberia.

As we build scenarios for the future market for wood pellets in China, all of the various forms of renewable energy that can replace coal must be considered. These include hydro, wind, wave, solar and geothermal power. Nuclear power was once viewed as a major solution, but a string of technical and operational problems and natural disasters has dimmed the potential of this source.

China is just completing the construction of the largest hydro-electric and flood control efforts ever undertaken by man, the Three Gorges dam, which is reported to reduce coal consumption by 31 million tons annually, or less than one percent of the total demand.

The country is also using agricultural and domestic waste material as an energy source. Much of China’s current pellet production is based on agricultural products. Sources of wood biomass that can be used for fuel and/or wood pellet production include the following, which are listed from the most readily available and lowest costs by North American standards: residual products created at the mill while manufacturing solid wood products (specifically lumber); woody material leftover from currently harvested areas including poor quality trees, small stems, and tree species with no market; intensively-managed, short rotation energy plantations; and material generated from thinning of established forest stands.

Given the low labor costs in China, cost and availability may change, but the sources with respect to available wood biomass should be similar.

When residual products are considered, reports indicate that most material within China is currently being used as solid wood fuel, and that unauthorized harvesting and removal of material from natural forests and plantations for energy is a problem in some areas.

Additionally, two major sources of logs imported into China are Russian Siberia and various tropical nations; it’s possible that an amount of material for pellet production could be generated from these sources.

While the ultimate market form that will exist in China is uncertain, it must be recognized that a global competitive market for wood pellets is in the formative stage, and China is a part of this market.

As of Feb. 6, there were 180 opportunities listed on this site to sell wood pellets in the Global Market, including a number from China. Few of the requests for quotes list a price, however, an essential component of a competitive market system. Given the scarcity of resources in China and the ownership structure of the electrical generating facilities, it is logical to assume that there will be some form of an oligopsony type market. The main focus of this market segment will be negotiation and contracting with suppliers of raw material and transportation. The potential need for wood pellets for cofiring in China is so great that it is doubtful that any one market form will satisfy the total demand.

With increased markets, all indications are that higher demand will have an upward impact on price.

The upward impact, however, will be free of the influence resulting from the cartel associated with petroleum suppliers. The upward pressure will be limited in North America, however, by the existing infrastructure to move pellets from North America to the Asian nations. In concert with the development of infrastructure, we must also become more aware of the true sustainable levels of biomass production that each nation can contribute to the global market. When considering the total consequences of increased use of renewable biomass energy on a global basis, price is important, but it is a small issue when compared to biologically-sustainable supply and ecological sustainability.

This article was excerpted from http://biomassmagazine.com/articles/8837/asian-markets-for-wood-pellets

-------------------------------------------------------------------------------------------------------------------------------------------------

If you have many waste thing like grass, sawdust, wood log or any other organic materials, you don’t know how to deal with it or just through them away directly before. But it still needs to pay for money and energy for that process. Also it is big waster for materials.